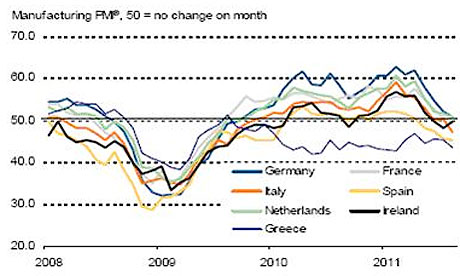

Eurozone manufacturing PMI data. Source: Markit

Factory activity in the UK and the rest of Europe worsened sharply last month, triggering fresh fears of a double-dip recession.

In Britain, manufacturing shrank at its fastest pace in more than two years as export orders plummeted. Growth in Germany's manufacturing sector – until now the star performer in the western world and the engine of growth in the eurozone – has almost ground to a halt while factory output in France, Italy and Spain is contracting.

A closely watched monthly survey from Markit/CIPS showed the UK manufacturing headline index dipping to 49 in August from 49.4 in July. Export orders plunged, with the measure falling to 46.6 from 53.8. A number below 50 signals contraction.

"The second half of 2011 has so far seen the UK manufacturing sector, once the pivotal cog in the economic recovery, switch into reverse gear," said Rob Dobson, senior economist at Markit. August saw production fall for the first time since May 2009 on the back of the sharpest deterioration in new orders for two-and-a-half years. There was also a slight drop in employment levels as manufacturers sought to cut costs.

"The sudden and substantial drop in new export orders is particularly worrisome, with UK manufacturers hit by rising global economic uncertainty, just as austerity measures are ramping up at home. As consumer and business confidence are slumping both at home and abroad, it is hard to see where any near-term improvement in demand will spring from."

Alan Clarke at Scotia Capital agreed. "The much hoped-for revival of manufacturing as an engine of growth for the wider economy has run out of juice."

German manufacturing grew at the slowest pace in almost two years due to a sharp drop in new orders last month. Markit's purchasing managers' index fell for the fourth month in a row to 50.9 for August, the weakest level since September 2009 and compared with 52 in July.

"Slower manufacturing growth mainly reflected the sharpest fall in new export orders since mid-2009," said Tim Moore, senior economist at Markit. "Heightened uncertainty about the global economic outlook and the escalating euro area debt crisis were cited as the main reasons why export clients put the brakes on spending in August."

The German economy grew by just 0.1% in the second quarter, even less than the UK at 0.2%.

In France, the eurozone's second-largest economy, the picture was even worse – the manufacturing sector contracted for the first time since July 2009. The PMI dropped to 49.1 in August from 50.5 in July, casting another shadow over France, which is already struggling with high unemployment, stagnant wages and weak consumer spending.

Manufacturing in Italy, the eurozone's third-largest economy, shrank at its fastest rate in two years, with its PMI falling to 47 from 50.1. Spain's factory activity contracted for the fourth month in a row in August. Its PMI slipped to 45.3 from 45.6.

"The eurozone manufacturing PMIs for August make bleak reading, with deterioration across virtually all countries and also across most components of the surveys," said Howard Archer, chief UK and European economist at IHS Global Insight. "Not only are the southern periphery eurozone countries and Ireland continuing to struggle markedly but there is also a sharp slowdown in manufacturing activity in the previously healthily performing core northern eurozone economies."

On the other side of the Atlantic, US manufacturing is expected to have shrunk in August for the first time in two years. The Institute for Supply Management will release its monthly survey at 3pm BST London time. While China's manufacturing industry bounced back last month, a decline in export orders – the first since April 2009 – raised concerns.

by Julia Kollewe taken from http://www.guardian.co.uk/business/2011/sep/01/weak-manufacturing-data-double-dip

In Britain, manufacturing shrank at its fastest pace in more than two years as export orders plummeted. Growth in Germany's manufacturing sector – until now the star performer in the western world and the engine of growth in the eurozone – has almost ground to a halt while factory output in France, Italy and Spain is contracting.

A closely watched monthly survey from Markit/CIPS showed the UK manufacturing headline index dipping to 49 in August from 49.4 in July. Export orders plunged, with the measure falling to 46.6 from 53.8. A number below 50 signals contraction.

"The second half of 2011 has so far seen the UK manufacturing sector, once the pivotal cog in the economic recovery, switch into reverse gear," said Rob Dobson, senior economist at Markit. August saw production fall for the first time since May 2009 on the back of the sharpest deterioration in new orders for two-and-a-half years. There was also a slight drop in employment levels as manufacturers sought to cut costs.

"The sudden and substantial drop in new export orders is particularly worrisome, with UK manufacturers hit by rising global economic uncertainty, just as austerity measures are ramping up at home. As consumer and business confidence are slumping both at home and abroad, it is hard to see where any near-term improvement in demand will spring from."

Alan Clarke at Scotia Capital agreed. "The much hoped-for revival of manufacturing as an engine of growth for the wider economy has run out of juice."

German manufacturing grew at the slowest pace in almost two years due to a sharp drop in new orders last month. Markit's purchasing managers' index fell for the fourth month in a row to 50.9 for August, the weakest level since September 2009 and compared with 52 in July.

"Slower manufacturing growth mainly reflected the sharpest fall in new export orders since mid-2009," said Tim Moore, senior economist at Markit. "Heightened uncertainty about the global economic outlook and the escalating euro area debt crisis were cited as the main reasons why export clients put the brakes on spending in August."

The German economy grew by just 0.1% in the second quarter, even less than the UK at 0.2%.

In France, the eurozone's second-largest economy, the picture was even worse – the manufacturing sector contracted for the first time since July 2009. The PMI dropped to 49.1 in August from 50.5 in July, casting another shadow over France, which is already struggling with high unemployment, stagnant wages and weak consumer spending.

Manufacturing in Italy, the eurozone's third-largest economy, shrank at its fastest rate in two years, with its PMI falling to 47 from 50.1. Spain's factory activity contracted for the fourth month in a row in August. Its PMI slipped to 45.3 from 45.6.

"The eurozone manufacturing PMIs for August make bleak reading, with deterioration across virtually all countries and also across most components of the surveys," said Howard Archer, chief UK and European economist at IHS Global Insight. "Not only are the southern periphery eurozone countries and Ireland continuing to struggle markedly but there is also a sharp slowdown in manufacturing activity in the previously healthily performing core northern eurozone economies."

On the other side of the Atlantic, US manufacturing is expected to have shrunk in August for the first time in two years. The Institute for Supply Management will release its monthly survey at 3pm BST London time. While China's manufacturing industry bounced back last month, a decline in export orders – the first since April 2009 – raised concerns.

by Julia Kollewe taken from http://www.guardian.co.uk/business/2011/sep/01/weak-manufacturing-data-double-dip

No comments:

Post a Comment